Direct-to-consumer (DtC) sales from U.S. wineries are expected to reach $3 billion in 2018, according to a newly released report by ShipCompliant and Wines & Vines Analytics.

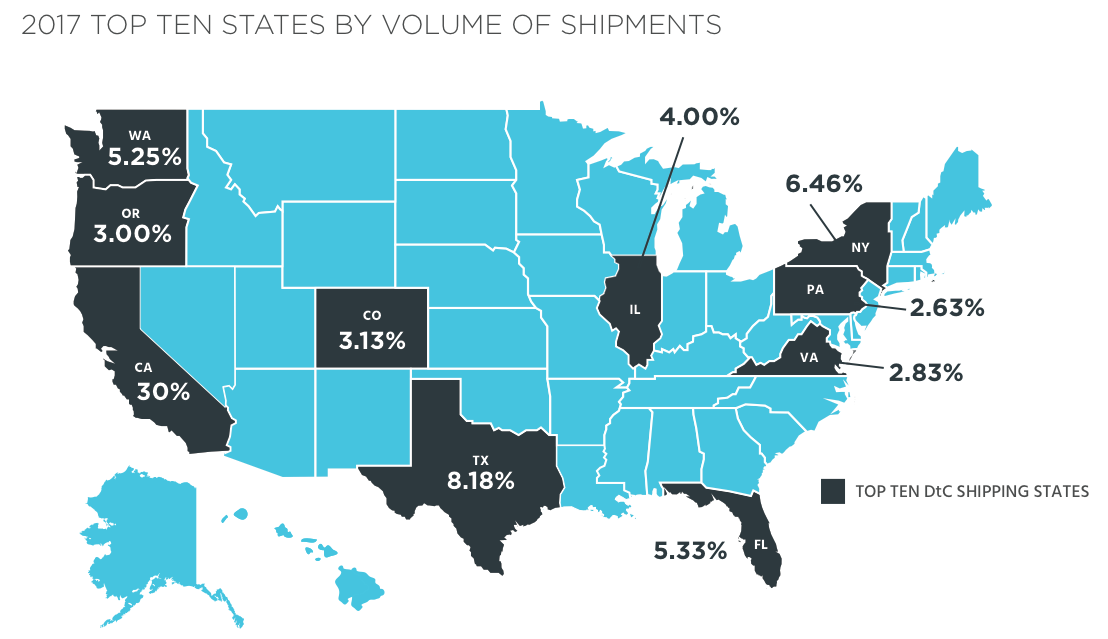

The findings forecast continued growth in DtC after it reached sales of $2.69 billion in 2017 and $2.33 billion in 2016. About 10% of total domestic wine sales in 2017 were DtC — up from 8.6% in 2016.

“Wineries shipped 5.78 million cases of wine in 2017,” the report states. “Helping to fuel this growth in value, the average price-per-bottle shipped inched up by $0.06 to $38.75.”

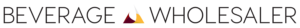

Another positive development in 2017 was Pennsylvania allowing DtC shipments for the first time. It ranked in the top 10 states in DtC volume of shipments in 2017, with much room for growth moving forward.

Oklahoma is scheduled to open its borders for DtC this October, leaving Utah, Kentucky, Mississippi, Alabama and Delaware as the only states that do not permit the practice.

Cabernet sauvignon, pinot noir, red blends, chardonnay and zinfandel were the five most commonly shipped wines last year, according to the report. They accounted for 60% of the volume of shipments and 73% of the value.

“Rosé shipments increased by 58% over 2016 without taking any decrease in average price-per-bottle shipped, amounting to pure organic growth,” the report states. “The 58% year-over-year increase in the volume of rosé shipped in 2017 is the largest annual increase recorded for the popular pink wine. Its share of volume in the DtC channel has increased by 200% since 2010, the largest increase in share of any wine tracked. It now accounts for 3.1% of all shipments, equal to merlot and sparkling wine.”

Syrah was another bright spot last year. Its shipments increased by 19% on a 6% decrease in average price-per-bottle-shipped. Cabernet sauvignon shipments increased 16% in volume and 18% in value over 2016, and had an average price-per-bottle-shipped of $69.54. The $120 million in additional cabernet sauvignon shipments drove 33% of the value growth of the entire DtC shipping channel, the report states. Pinot noir shipments increased 15% in volume and 16% in value last year.

“By nearly every measure, the winery DtC shipping channel continues to outperform every other retail channel in the United States, be it grocery stores, independent fine wine shops or convenience stores,” the report says. “The results for 2017 outlined in this report show that the DtC shipping channel increased in both volume and value at a rate far above the overall retail channel.”

The main competition for winery direct shipments is “direct shipments from licensed retailers,” the report adds. “Currently, licensed retailers are only legally allowed to ship to 13 states and the District of Columbia. However, retailer shipping bills are becoming more common, and three current lawsuits challenge restrictions in Illinois, Michigan and Missouri. It is possible that more states will allow retailer shipments and that courts may overturn current bans on shipments, which may pose a challenge for winery DtC shipping growth.”

Graphics courtesy of Sovos.